TSMC Reclaims Top 10 Spot Amid AI-Driven Surge

Taiwan Semiconductor Manufacturing Company (TSMC) has once again secured its position among the world's 10 most valuable companies, fueled by the artificial intelligence (AI) boom that has propelled its stock to unprecedented levels.

According to a Bloomberg report, TSMC shares experienced a 14% surge last week, driving the chipmaker's market capitalization to a record high. Although early trading on Monday, March 11, saw a slight dip of 2%, the company's market capitalization remained substantial at $634 billion.

The report highlights that this minor setback did not significantly impact the company, as its market share still surpasses that of Broadcom.

Analyst Perspectives on TSMC's Growth

Analysts at Morgan Stanley and JPMorgan Chase & Co. anticipate continued growth for the semiconductor giant, whose clientele includes Apple, Nvidia, and Qualcomm. This optimistic outlook is based on the expectation of soaring AI-related revenue and the company's robust pricing power.

Charlie Chan and other Morgan Stanley analysts noted in a recent report that "Generative AI semi is an obvious growth driver for TSMC." They also emphasized that the company's international expansion efforts help to alleviate geopolitical concerns.

Revenue Boosted by AI Demand

TSMC's revenue experienced a 9.4% increase in the first two months of 2024, driven by heightened demand for high-end chips as a result of increased activity in the field of artificial intelligence.

Nvidia's "AI Boost"

Nvidia is another chip company whose stock has experienced an upward trend this year. The company has benefited from the intense interest surrounding generative AI.

Over the past month, Nvidia's stock price has increased by more than 20%. The stock has risen by over 90% in the last six months. Furthermore, over the past year, Nvidia's stock price has risen from $234.36 per share to $875.28 per share, representing a 275% increase.

Newer articles

Older articles

Indian Astronaut Joins ISS: Shukla's Mission Ushers in New Era for India's Space Program

Indian Astronaut Joins ISS: Shukla's Mission Ushers in New Era for India's Space Program

Ashada Gupt Navratri 2025: Unveiling Dates, Sacred Rituals & Hidden Significance

Ashada Gupt Navratri 2025: Unveiling Dates, Sacred Rituals & Hidden Significance

Rishabh Pant's Unconventional Batting Redefining Cricket, Says Greg Chappell

Rishabh Pant's Unconventional Batting Redefining Cricket, Says Greg Chappell

Moto G54 Price Slashed in India: Check Out the New, Lower Cost

Moto G54 Price Slashed in India: Check Out the New, Lower Cost

JPG to PDF: A Graphic Designer's Guide to File Conversion and Quality Preservation

JPG to PDF: A Graphic Designer's Guide to File Conversion and Quality Preservation

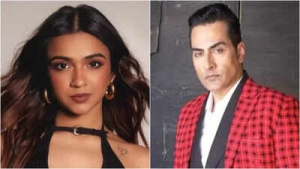

'The Traitors' Star Apoorva Mukhija Accuses Sudhanshu Pandey of Misogyny and Verbal Abuse After On-Screen Drama

'The Traitors' Star Apoorva Mukhija Accuses Sudhanshu Pandey of Misogyny and Verbal Abuse After On-Screen Drama

Van der Dussen to Captain South Africa in T20I Tri-Series Against New Zealand and Zimbabwe

Van der Dussen to Captain South Africa in T20I Tri-Series Against New Zealand and Zimbabwe

20 Minutes to a Healthier Brain and Heart: Neurologist's Simple Strategies to Combat Cholesterol, Blood Pressure, and Dementia Risk

20 Minutes to a Healthier Brain and Heart: Neurologist's Simple Strategies to Combat Cholesterol, Blood Pressure, and Dementia Risk

England's Audacious Batters Claim They Could Have Chased Down 450 in First Test Win Over India

England's Audacious Batters Claim They Could Have Chased Down 450 in First Test Win Over India

Popular Finance YouTuber "financewithsharan" Hacked: Security Measures to Protect Your Account

Popular Finance YouTuber "financewithsharan" Hacked: Security Measures to Protect Your Account